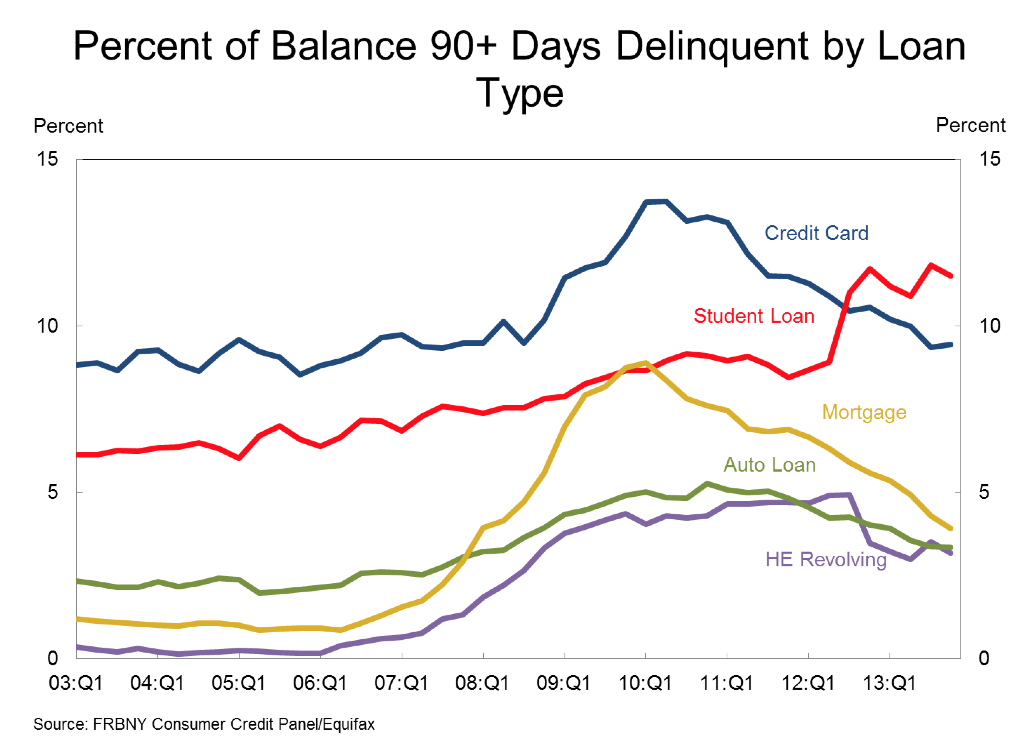

Back in 2010, student loan debt outstanding in the United States surpassed outstanding credit card debt. Student loan debt hit the $1 trillion mark in 2013. It’s still the fastest growing consumer debt and a lot of it isn’t getting paid back. That’s according to the most recent consumer debt report by the Federal Reserve Bank of New York released on February 18, 2014.

This article also appeared here.

The Federal Reserve Bank of New York tracks student loans, both those issued by the federal government and private banks, and releases a quarterly report. In the 2013 year-end report (Q4 2013), outstanding student loan balances reported on credit reports increased to $1.08 trillion, a $114 billion increase for 2013. About 11.5% of student loan balances are 90+ days delinquent or in default. That makes them both the fastest growing and the most troubled type of consumer loan. (Click on the chart above to see a larger version).

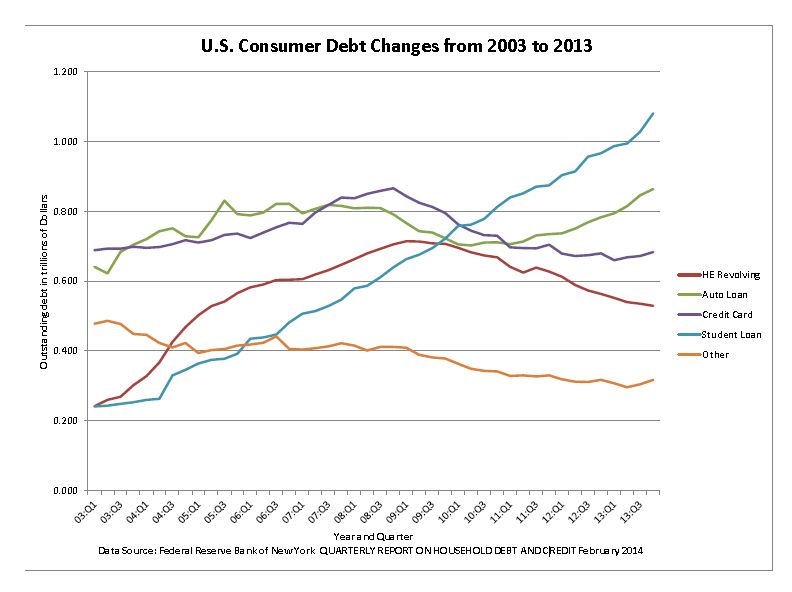

I created this time series chart to show how student loan debt has grown over the past decade. (Click on the chart to see a larger version. Student debt is colored in blue.) The data came from this page on the FRBNY website. I used “page 3” data, but deleted mortgage debt because its overall size dwarfs all the other consumer debt categories and you wouldn’t be able to see the shocking increase in student loan debt. The debt is increasing due to both new loans being taken out by students and interest charges accruing on old loans.

In a February 2014 FRBNY blog post analysis of growing student loan debt, Just Released: Who’s Borrowing Now? The Young and the Riskless!, the authors point out that while overall debt fell between 2006 and 2013 (as households retrenched after the 2008 credit crisis), student loans grew.

“First, student loans grew the most of any debt product in both periods (in percentage terms). Second, the growth in educational debt, like that of auto loans, is concentrated among the lower and middle credit score groups.”

Here’s a link to the Federal Reserve Bank of New York Report and to an interactive chart showing how student loan debt is hitting the young and those with low credit scores the hardest.